In the past days of the real estate boom, the application for mortgage loans was very loose, and many lenders accepted the applicant’s commitment to annual income without examination and verification. After the economic downturn, many borrowers’ income cannot continue to repay their loans, which has become a nightmare. That’s the main reason why Form 4506 T is so popular today.

What is Form 4506 T and What is It Used for?

To prevent a recurrence of these liar loans, mortgage applicants now are asked to sign an IRS form, namely Form 4506 T, to authorize the release of up to four years of tax returns to the loan officer. Other financial institutions, and even mortgage investors, can have similar requests as well. You can use this form to order a transcript or other return information free of charge or designate a third party to receive the information.

The object, of course, is to throw the widest possible net to capture fraudulent claims of income, thus limiting future loan losses.

Another function of Form 4506-T is to apply for a COVID EIDL loan. All COVID EIDL applicants are required to submit a signed and dated Form 4506-T authorizing the IRS to release business tax transcripts for SBA to verify their revenue.

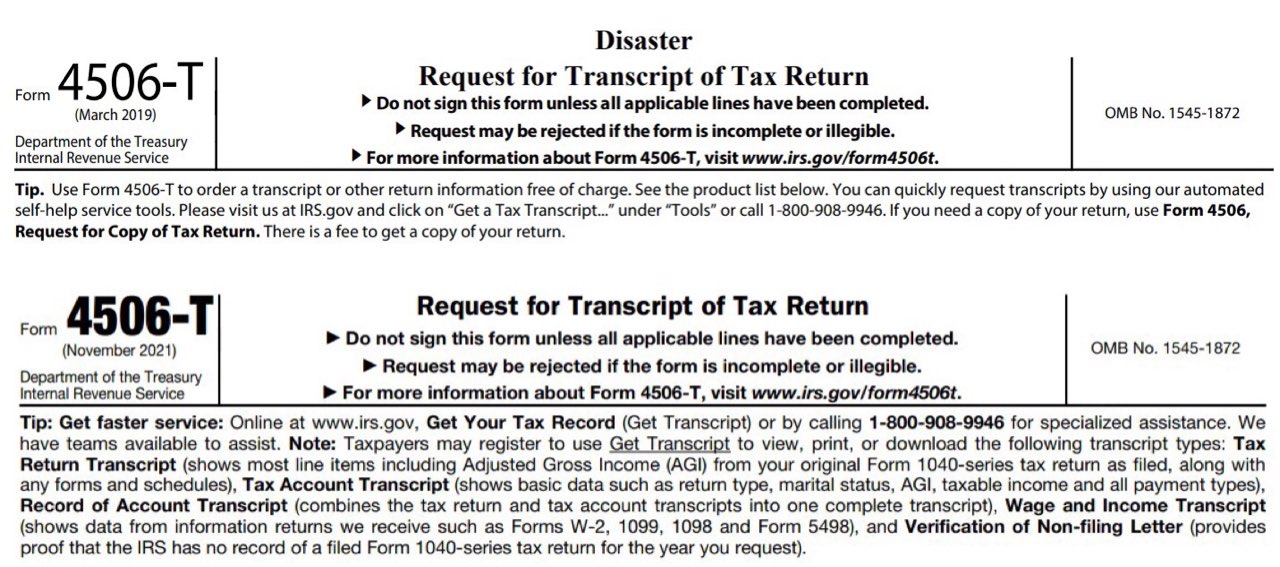

There are differences between Form 4506-T and the COVID EIDL loan Form 4506-T. They have different titles. The ordinary Form 4506-T carries the title of “Request for Transcript of Tax Return” while the other “Disaster Request for Transcript of Tax Return” with “Disaster” added.

So, it’s quite important to use the correct Form 4506-T to avoid errors.

How to Correctly Complete Form 4506 T

4506 T form contains so many blanks to be completed that it’s chaotic to figure out how to complete it correctly. The following provides all the filling tips for each blank. The blanks that are required to be completed on Form 4506 T include:

- 1a—Name of Tax Filer

- 1b—Social Security Number of Filer

- If a joint return complete lines 2a and 2b with spouse information

- 3—Current address

- 4—Previous address if you have moved in the last 2 years.

- Leave line 5 blank. NIU does not use the 3rd party option.

- 6—Transcript Requested—Write 1040 and check the box at the end of line 6a.

- 9—List the last calendar day of the tax year you are requesting the Tax Return Transcript (i.e. if requesting 2021 taxes please list 12/31/2021).

- Read the declaration indicating you are the taxpayer listed in line 1a and check the box above the signature line.

- Sign and date the form and list your phone number at the bottom of the form.

How to Send Form 4506 T?

There are two ways to send the 4506 T form, one is through fax and the other is through mail. I’ll teach you how to operate each.

Send Form 4506 T via Fax

The Fax app allows its users to send and receive a fax at any time and place.

Step 1. Download and install the FAX app on your device, smartphone, or tablet and purchase a fax plan based on your needs.

Step 2. Fill in the Form 4506 T and scan it via the webcam on your device or directly attach your Form 4506 T from a third-party platform.

Step 3. Select a cover sheet and sign, edit, preview the fax document to be sent, and click the button “Send” to complete faxing.

Send Form 4506 T via Mail

The traditional mail method is so familiar to everyone although it is old school.

Step 1. Download, print Form 4506 T and fill in the 4506 T form correctly and eligibly.

Step 2. Mail the form to IRS based on the addresses provided below.

Where to Fax to

Do not submit a copy of the 4506 T to the Financial Aid and Scholarships Office. Please submit the form directly to the IRS at the address or fax number listed for your state of residence at the time your return was filed.

Fax Numbers to Send to

The following covers all the fax numbers you may need to send 4506 T form via fax. Different fax numbers are used based on different states.

- If you live in Florida, Louisiana, Mississippi, Texas, a foreign country, American Samoa, Puerto Rico, Guam, the Commonwealth of the Northern Mariana Islands, the U.S. Virgin Islands, or A.P.O. or F.P.O. address, fax to 855-587-9604.

- If you live in Alabama, Arkansas, Delaware, Georgia, Illinois, Indiana, Iowa, Kansas, Maine, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, North Carolina, Oklahoma, South Carolina, Tennessee, Vermont, Virginia, Wisconsin, fax to 855-821-0094.

- If you live in Alaska Arizona, California, Colorado, Connecticut, District of Columbia, Hawaii, Idaho, Kansas, Maryland, Michigan, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Dakota, Utah, Washington, West Virginia, Wyoming, fax to 855-298-1145.

Form 4506 T Mail Address

When you want to mail, here is what you need to pay attention to. You need to print this form and fill it out correctly, and then mail it according to the following address.

- If you live in Florida, Louisiana, Mississippi, Texas, a foreign country, American Samoa, Puerto Rico, Guam, the Commonwealth of the Northern Mariana Islands, the U.S. Virgin Islands, or the A.P.O. or F.P.O. address, mail to Internal Revenue Service RAIVS Team Stop 6716 AUSC Austin, TX 73301.

- If you live in Alabama, Arkansas, Delaware, Georgia, Illinois, Indiana, Iowa, Kansas, Maine, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, North Carolina, Oklahoma, South Carolina, Tennessee, Vermont, Virginia, Wisconsin, mail to Internal Revenue Service RAIVS Team Stop 6705 S-2 Kansas City, MO 64999.

- If you live in Alaska Arizona, California, Colorado, Connecticut, District of Columbia, Hawaii, Idaho, Kansas, Maryland, Michigan, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Dakota, Utah, Washington, West Virginia, Wyoming, mail to Internal Revenue Service RAIVS Team P.O. Box 9941 Mail Stop 6734 Ogden, UT.

Bottom Line

- Individuals who are required to file taxes and selected for verification by the Department of Education must provide Tax Return Transcripts. Individuals can obtain the Tax Transcript online or by submitting an IRS Form 4506 T to the IRS.

- As long as you follow the steps mentioned above, you can send 4506 T by mail or fax to the right address with no difficulty.

Related Posts:

One thought on “How to Complete and Send Form 4506-T to IRS”